Finally, is the avant-garde of Keynesian thought only now (re)discovering the Exter inverted pyramid? Because one can spend 30 minutes reading the Spellman essay, or... cast a quick glance at the picture above (click on graphic to enlarge) to understand the true value of everything in a world in which the monetary fabulation of the past 99 years is finally unwinding.

Finally, is the avant-garde of Keynesian thought only now (re)discovering the Exter inverted pyramid? Because one can spend 30 minutes reading the Spellman essay, or... cast a quick glance at the picture above (click on graphic to enlarge) to understand the true value of everything in a world in which the monetary fabulation of the past 99 years is finally unwinding.

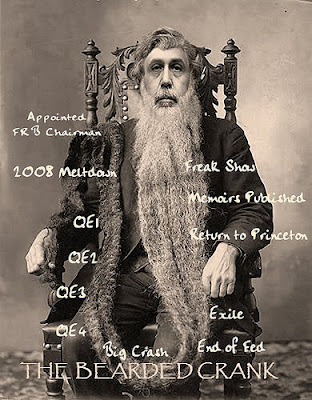

One picture in this case is absolutely worth well over a thousand words.

Heres another thousand for you, 'The Bearded Crank.'

Max Keiser Adds: At the height of the bubble in 2007, central banks were net sellers of gold and the bull market that started in 2000 had still not been noticed by anyone except readers of this site and a few others. In 2012, central banks are buyers and the bull market in gold is understood by a few folks who are accumulating. But going back hundreds of years, even thousands of years gold has always been the cornerstone of the economy. The only thing that changes is perception. When Wall St. delusions reign there is a belief that paper can trump gold. Then the house of cards tumbles and we’re back to gold. This gold bull market will be clearly understood by all when gold and the Dow are 1:1 somewhere in the $7,000 – $8,000 range.

Heres another thousand for you, 'The Bearded Crank.'

Max Keiser Adds: At the height of the bubble in 2007, central banks were net sellers of gold and the bull market that started in 2000 had still not been noticed by anyone except readers of this site and a few others. In 2012, central banks are buyers and the bull market in gold is understood by a few folks who are accumulating. But going back hundreds of years, even thousands of years gold has always been the cornerstone of the economy. The only thing that changes is perception. When Wall St. delusions reign there is a belief that paper can trump gold. Then the house of cards tumbles and we’re back to gold. This gold bull market will be clearly understood by all when gold and the Dow are 1:1 somewhere in the $7,000 – $8,000 range.

No comments:

Post a Comment