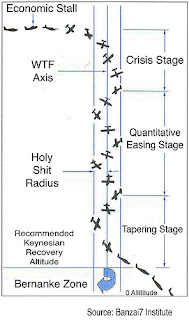

Submitted by Tyler Durden: One of the most insightful comments explaining what happened last night, when Bernanke just killed all credibility that

the economy may soon be able to stand up on its own two legs, comes

from Seth Klarman who crushed the logic (or lack thereof) behind

proclaiming any recovery in a world in which the only marginal factor

preventing an all out collapse in the stock market and thus economy is,

and continues, to be the Federal Reserve which has not only destroyed

the market's discounting function, but with every passing day is taking

over both the entire US economy (the Fed's balance sheet is now 25% of

US GDP) and the US bond market (currently in possession of 30% of all 10

Year equivalents).

Submitted by Tyler Durden: One of the most insightful comments explaining what happened last night, when Bernanke just killed all credibility that

the economy may soon be able to stand up on its own two legs, comes

from Seth Klarman who crushed the logic (or lack thereof) behind

proclaiming any recovery in a world in which the only marginal factor

preventing an all out collapse in the stock market and thus economy is,

and continues, to be the Federal Reserve which has not only destroyed

the market's discounting function, but with every passing day is taking

over both the entire US economy (the Fed's balance sheet is now 25% of

US GDP) and the US bond market (currently in possession of 30% of all 10

Year equivalents).If the economy is so fragile that the government cannot allow failure, then we are indeed close to collapseAnd the rest of Klarman's sermon, serving as the perfect counter to the voodoo shamans operating their Keynesian religion in the Marriner Eccles building. From Seth Klarman of Baupost:

Is it possible that the average citizen understands our country's fiscal situation better than many of our politicians or prominent economists?That is all.

Most people seem to viscerally recognize that the absence of an immediate crisis does not mean we will not eventually face one. They are wary of believing promises by those who failed to predict previous crises in housing and in highly leveraged financial institutions.

They regard with skepticism those who don't accept that we have a debt problem, or insist that inflation will remain under control. (Indeed, they know inflation is not well under control, for they know how far the purchasing power of a dollar has dropped when they go to the supermarket or service station.)

They are pretty sure they are not getting reasonable value from the taxes they pay.

When an economist tells them that growing the nation's debt over the past 12 years from $6 trillion to $16 trillion is not a problem, and that doubling it again will still not be a problem, this simply does not compute. They know the trajectory we are on.

When politicians claim that this tax increase or that spending cut will generate trillions over the next decade, they are properly skeptical over whether anyone can truly know what will happen next year, let alone a decade or more from now.

They are wary of grand bargains that kick in years down the road, knowing that the failure to make hard decisions is how we got into today's mess. They remember that one of the basic principles of economics is scarcity, which is a powerful force in their own lives.

They know that a society's wealth is not unlimited, and that if the economy is so fragile that the government cannot allow failure, then we are indeed close to collapse. For if you must rescue everything, then ultimately you will be able to rescue nothing.

They also know that the only reason paper money, backed not by anything tangible but only a promise, has any value at all is because it is scarce. With all the printing, the credibility of our entire trust-based monetary system will be increasingly called into question.

And when you tell the populace that we can all enjoy a free lunch of extremely low interest rates, massive Fed purchases of mounting treasury issuance, trillions of dollars of expansion in the Fed's balance sheet, and huge deficits far into the future, they are highly skeptical not because they know precisely what will happen but because they are sure that no one else--even, or perhaps especially, the policymakers—does either.

Source

WB7

No comments:

Post a Comment