Repeating the same mistake twice, on a far larger scale in a far shorter timeframe is idiocy on such a grand scale that it’s worthy of applause.

Let’s hear it for Greece.

Here in the land of an already-popped bubble, shattered dreams and a population pushed towards the breaking-point by banksters and their games, one would think a few lessons had been learned.

Sadly, no.

Greek bankster Theodoros Kalantonis, who has survived the worst of times the past six years, said he can finally see the resurrection of home lending.

But our sympathies aside … Isn’t Greece the land of the non-performing loan? Did that problem somehow disappear while we weren’t paying attention?

Let’s take a look: In the first quarter of this year Greek NPL’s were… (wait for it)…

33.5%

So here’s a country which just saw a jaw-dropping NPL rate of 33.5% in the first quarter, now bragging about a “resurrection in home lending” and planning to quadruple of housing loans by next year.

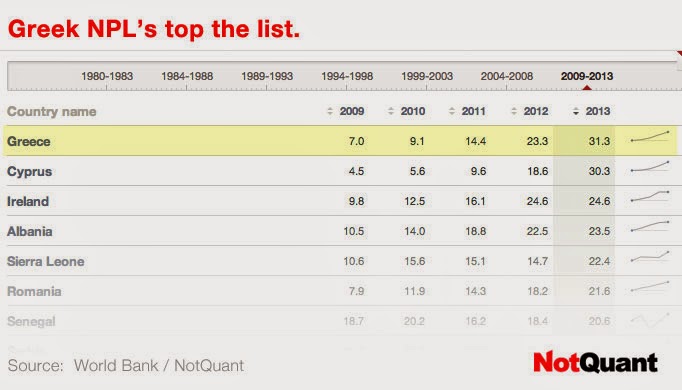

How does Greece’s dismal rate of NPL’s compare to the rest of the world?

But wait, say the arsonists who burned down the house last time bankers leading the charge,

there’s an explanation for all those non-performing loans. See, back

in 2010 the Greek government passed a law to prevent people from losing

“their” homes. (We use the term, “their” loosely). As well-intentioned

as that law may have been, it essentially enabled Greeks to stop paying

their mortgages — even those that could afford them. Most of

Greek defaulters, according to the bankers, are so-called

“strategic-defaulters” and actually can pay. Now a new law is going into effect that will force Greeks who can pay to pay.

Besides, this law won’t do anything. Greeks, possibly more than any people on Earth are incredibly skilled at navigating and beating the system. If they’re not paying now, they’re not going to be paying after a law that says “you really, really need to pay” gets passed.

Furthermore, if Greece is supposedly “clawing it’s way out of the recession” during a period where nobody is actually paying their mortgage, exactly what do these financial geniuses think is going to happen to consumer spending if and when all those ‘strategic defaulters’ are suddenly forced to pay up?

Ultimately, the real story here is that Greek bankers are once again using short-termism to generate a windfall of quick profits that will likely cause the economy to go over the edge again in the medium term. The other story of course, is that the government is defending housing-inflation as a “good thing”, and pretending that a reduction in the price of houses is somehow “bad”. Read carefully how they compare their own experience to that of Spain:

And why are housing prices going up in Greece anyway?

Well.. average wages fell by almost 8% last year.

And unemployment barely budged:

It’s clear that nothing has been learned whatsoever. The bankers are still completely in charge, and the next implosion is already gathering steam. Short Greece. The criminals are running the show. This will certainly end extremely badly in a shorter amount of time than it did before.

As long as the inflated prices at the peak of the bubble are considered “normal”, all attempts to regain “normalcy” will swiftly be followed by collapse. And as long as economic policy is set with an eye to maintaining asset values, those without assets will continue to lose ground– and require increasing amounts of unsustainable leverage to survive. Such a system will and must collapse.

Source

Related: Century Of Enslavement - The History Of The Fed

Let’s hear it for Greece.

Here in the land of an already-popped bubble, shattered dreams and a population pushed towards the breaking-point by banksters and their games, one would think a few lessons had been learned.

Greek bankster Theodoros Kalantonis, who has survived the worst of times the past six years, said he can finally see the resurrection of home lending.

…Greece’s four largest banks, encouraged as the economy claws itself out of recession, plan to double mortgage lending this year and may do it again in 2015, according to Kalantonis.Poor Greek banker Theodorus Kalantonis. We’re sure it was hard for him.

Home loan originations in Greece plunged from 15 billion euros at the peak in 2007 to less than 250 million euros ($340 million) last year, he said. Alpha Bank, the country’s fourth largest, and its competitors are counting on the growth rate of non-performing loans to stabilize once a law preventing banks from foreclosing on property is dismantled.

But our sympathies aside … Isn’t Greece the land of the non-performing loan? Did that problem somehow disappear while we weren’t paying attention?

Let’s take a look: In the first quarter of this year Greek NPL’s were… (wait for it)…

33.5%

So here’s a country which just saw a jaw-dropping NPL rate of 33.5% in the first quarter, now bragging about a “resurrection in home lending” and planning to quadruple of housing loans by next year.

How does Greece’s dismal rate of NPL’s compare to the rest of the world?

But don’t worry, they have a plan.

From January 2015, banks will use a new industry-wide index to calculate what is left over from a borrower’s annual salary once cost of living is deducted. The rest of their salary should go toward mortgage repayments, and if those in default refuse to pay what they can, banks will look at foreclosure, Kalantonis said.So the government will decide how much Greeks need to “live”, and then proceed to take “the rest of their salary”. What could possibly go wrong there?

Besides, this law won’t do anything. Greeks, possibly more than any people on Earth are incredibly skilled at navigating and beating the system. If they’re not paying now, they’re not going to be paying after a law that says “you really, really need to pay” gets passed.

Furthermore, if Greece is supposedly “clawing it’s way out of the recession” during a period where nobody is actually paying their mortgage, exactly what do these financial geniuses think is going to happen to consumer spending if and when all those ‘strategic defaulters’ are suddenly forced to pay up?

Ultimately, the real story here is that Greek bankers are once again using short-termism to generate a windfall of quick profits that will likely cause the economy to go over the edge again in the medium term. The other story of course, is that the government is defending housing-inflation as a “good thing”, and pretending that a reduction in the price of houses is somehow “bad”. Read carefully how they compare their own experience to that of Spain:

In Spain, banks foreclosed on about 330,000 properties after the nation’s real estate market crashed in 2007, according to PAH, a group that supports people who have lost their homes to lenders. That contributed to Spain’s 1.7 million units of unsold homes and sent prices, which have fallen more than 45 percent since the peak, on a downward spiral which has not yet stopped.Mistakes? What’s wrong with houses being 45% cheaper? Why are expensive houses “good”, and exactly how do Greeks benefit from being more leveraged by over-inflated housing prices?

…

“We studied the Spanish experience very carefully and we don’t want to repeat the mistakes they made,” he said.

And why are housing prices going up in Greece anyway?

Housing prices in Athens increased more than 170 percent from 1997 through the end of 2008, according to the data. As the recession took hold, apartment prices in Greece plunged by 33.4 percent between 2008 and the fourth quarter of 2013, according to the data.So if housing prices are rising again, it must be because the real underlying economy is improving again, right?

Well.. average wages fell by almost 8% last year.

And unemployment barely budged:

It’s clear that nothing has been learned whatsoever. The bankers are still completely in charge, and the next implosion is already gathering steam. Short Greece. The criminals are running the show. This will certainly end extremely badly in a shorter amount of time than it did before.

As long as the inflated prices at the peak of the bubble are considered “normal”, all attempts to regain “normalcy” will swiftly be followed by collapse. And as long as economic policy is set with an eye to maintaining asset values, those without assets will continue to lose ground– and require increasing amounts of unsustainable leverage to survive. Such a system will and must collapse.

Source

Related: Century Of Enslavement - The History Of The Fed

No comments:

Post a Comment